When people think of American esports, Los Angeles is often the first city that comes to mind. The proximity to multiple game studios, universities and the entertainment industry make it a natural fit to serve as America’s esports capital. Surprising many, the biggest esports hub outside of LA is the Dallas area. Team Envy and Complexity call Dallas home, as do multiple professional service companies. Nearby Arlington is home to Esports Stadium Arlington, the largest esports-focused facility in the United States.

While admittedly a bit biased, KemperLesnik believes Chicago is set to become the next big esports hub. We’re welcoming our first franchised team, Call of Duty’s Chicago Huntsmen, this year, and Chicago offers a central location with access to top schools and a growing community of innovators. This prime location makes it ideal for esports growth and events, such as ESL’s 2019 Intel Extreme Masters for Counterstrike: Global Offensive held at the United Center or the League of Legends 2016 World Championship Quarter Finals held at the Chicago Theatre. We think things are just getting started for the Windy City!

Innovation Hub

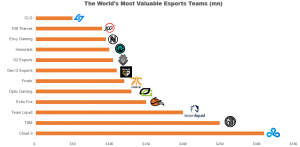

Chicago is home to many innovators, in startups as well as esports. Robert Morris University was the first school in the nation to offer an esports scholarship back in 2014. Collegiate esports has grow to the point that in 2019, $15 million was offered in esports scholarships across the country, with no signs of slowing down. Multiple universities have started to offer courses and build facilities to host esports events, including Division 1 schools such as Marquette University. Multiple esports stars got their start in Chicago as well, including Ninja (Fortnite), Nadeshot (100 Thieves) and Hector Rodriguez (Optic Gaming, NRG).

There are also multiple gaming and esports companies headquartered in Chicago. Ignite Gaming Lounge, a pay by the hour gaming lounge, features locations in Skokie and Chicago. Lightstream, a supplemental service for streaming platforms like Twitch, and NetherRealm Studio, who works on Mortal Kombat, both operate out of Chicago as well.

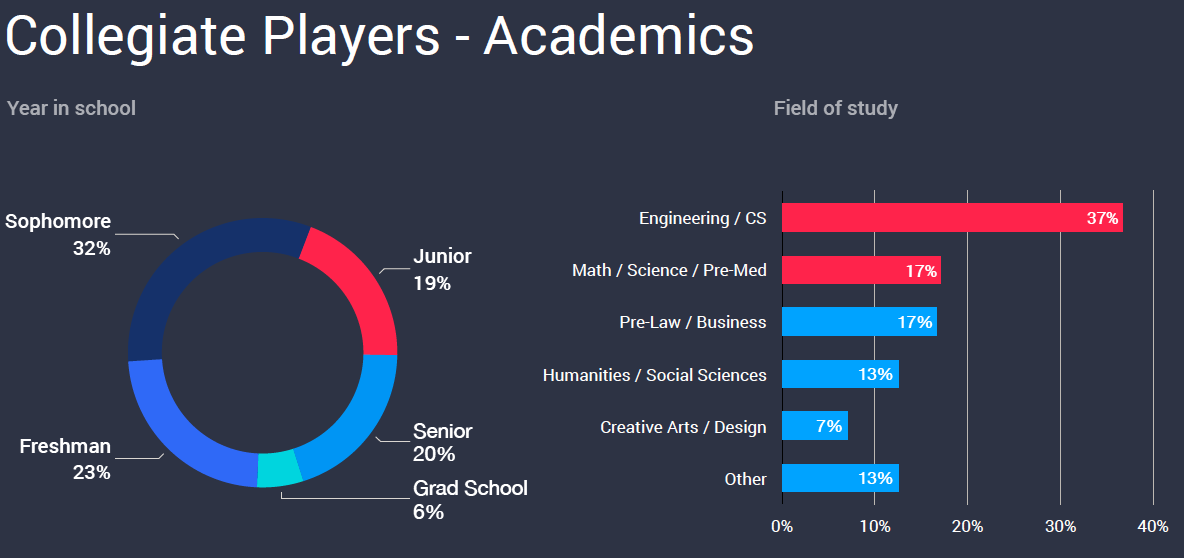

This innovative nature extends beyond esports into the broader tech community. 1871, Chicago’s top business incubator, is considered the best in the country, and among the best in the world. The State of Illinois awards the second-largest amount of computer science degrees in the US, placing only behind California. Many Illinois STEM graduates are now electing to stay in Illinois as well, with graduates 4.5 times more likely to stay in Illinois than go to San Francisco, the second top location. STEM students make up over half of those participating in their college’s esports programs, according to a study done by Midgame, an esports analytics company.

The STEM students of today will become the biggest esports fans of tomorrow. As Chicago grows as a hub for innovation and the demand for talented STEM workers grows, so too will the demand for local entertainment.

Schools

Chicago offers proximity to multiple colleges and universities, providing ample opportunity for company partnerships for developers, teams and professional services. Robert Morris is the obvious example, thanks to its successful esports program, but there are numerous schools teeming with esports talent, as well as potential fans.

Universities like Northwestern and the University of Chicago are considered some of the best in the nation, while DePaul University, Columbia College Chicago and Loyola all feature popular entrepreneurial programs. In 2018, DePaul University entered the esports space with multiple lounges across its two campuses. The Blue Demons also have a Rocket League team that recently won the EGF Big East Invitational, proving that DePaul Esports can compete on a high level. Only a few hours away is the University of Illinois Urbana-Champaign, not only one of the best engineering schools in the country, but home to one of the best collegiate League of Legends teams.

Esports in higher education cascades into the high school level in Chicago as well, with a robust competitive system and state-level governing body, IHSEA. Ben Bruce, a local high school esports coach for Barrington High School, a school in the northwestern suburbs, notes growth within his school’s program as well as the number of schools competing. “This is only the second year of our program at BHS, but our numbers have grown since last year. I see new schools starting programs, and have been reached out to often by other high schools for guidance. High school esports is growing rapidly in Illinois.” These high schools often compete in tournaments hosted by Robert Morris University, and will even travel out of state for events.

Location

Chicago serves as a hub for the entire Midwest. O’Hare International Airport is the country’s busiest airport and many train lines and roads converge in Chicago. Thanks to these numerous and convenient travel options, the city serves as a focal point for not only the Midwest, but the entire country. As more esports events pop up, Chicago will grow to become the ideal location for Midwest esports events, and also a central location for both national and international events.

Chicago’s location is also convenient due to the many food and beverage companies located within the city and surrounding region. Esports has proven to be a successful way to connect with an increasingly hard to reach audience of young people. F&B is an ideal esports sponsor, and with multiple F&B companies headquartered in Chicago, esports enterprises will be able to easily connect with potential sponsors directly.

Wrigley, makers of DoubleMint, Juicy Fruit and more, is often the first Chicago-based company that comes to mind thanks to Wrigley Field. However, many other food companies call Chicago home. McDonald’s, Kraft-Heinz and ConAgra are all headquartered in the Chicago area. GrubHub, one of Chicago’s tech darlings, sponsors esports team TSM.

Moving Forward

With multiple events coming to Chicago in 2020, including two possible Call of Duty events and IEM Chicago, more attention will come to the Windy City as the next big thing in esports. More events will welcome more sponsors and more demand for Chicago esports, encouraging more schools to invest in esports and more teams to participate in Chicago. With all of these changes, the KemperLesnik esports team looks forward to being part of the growing Chicago esports movement!